ccvediogames.ru

Community

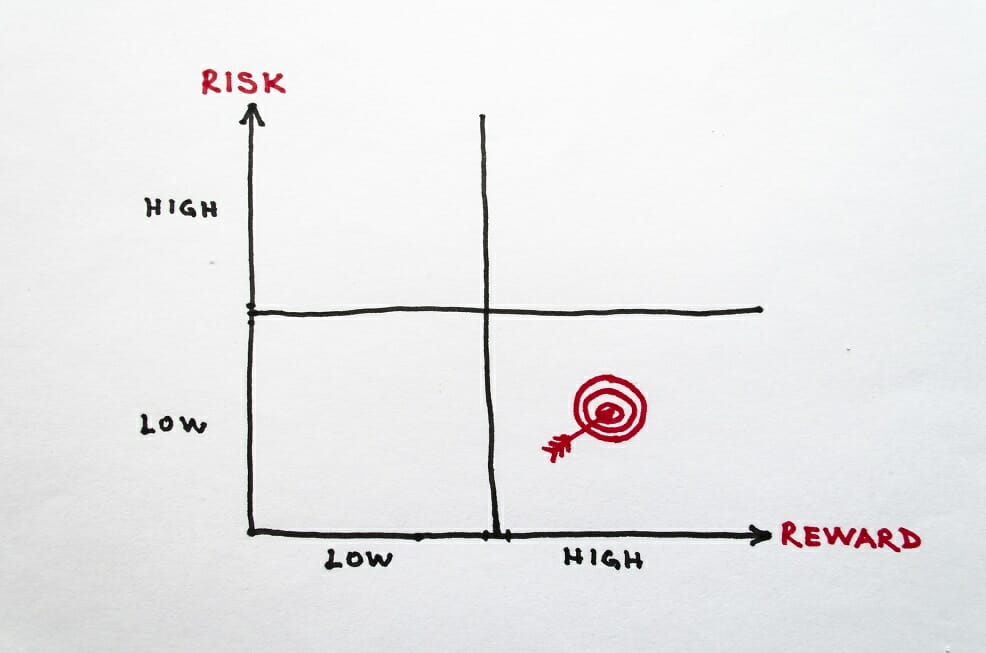

Risk Averse Investor

Speaking more practically, risk aversion is an important concept for investors. A risk averse investor prefers low risk investments that offer a guaranteed, or. Risk aversion is the behaviour exhibited by investors when they prefer outcomes with assured returns over outcomes which have higher, but uncertain returns. A risk averse investor is an investor who prefers lower returns with known risks rather than higher returns with unknown risks. A risk-averse investor will avoid taking on too much risk in their investment strategy. Risk-averse investment strategies will therefore veer towards. i. Risk-Averse. These are the investors that have to dislike the risk, so they basically like to make investments in the assets that have a sure return. Example: A risk-averse investor is someone who prefers to invest in low-risk options such as bonds or mutual funds rather than high-risk options like stocks or. Risk averse investing is a common approach for the short-term. Returns may be lower but they are less likely to be negative. The opposite is risk tolerance. In the short term, risk-averse investors are not making sudden changes to their portfolios. They are not making transactions during market fluctuations which. When the initial investment amount was lowered to $10 million, with a possible gain of $40 million, the managers were just as cautious: On average, they wouldn'. Speaking more practically, risk aversion is an important concept for investors. A risk averse investor prefers low risk investments that offer a guaranteed, or. Risk aversion is the behaviour exhibited by investors when they prefer outcomes with assured returns over outcomes which have higher, but uncertain returns. A risk averse investor is an investor who prefers lower returns with known risks rather than higher returns with unknown risks. A risk-averse investor will avoid taking on too much risk in their investment strategy. Risk-averse investment strategies will therefore veer towards. i. Risk-Averse. These are the investors that have to dislike the risk, so they basically like to make investments in the assets that have a sure return. Example: A risk-averse investor is someone who prefers to invest in low-risk options such as bonds or mutual funds rather than high-risk options like stocks or. Risk averse investing is a common approach for the short-term. Returns may be lower but they are less likely to be negative. The opposite is risk tolerance. In the short term, risk-averse investors are not making sudden changes to their portfolios. They are not making transactions during market fluctuations which. When the initial investment amount was lowered to $10 million, with a possible gain of $40 million, the managers were just as cautious: On average, they wouldn'.

Investors who are less risk averse may allocate more of their equity investment to riskier stocks and funds, though they may pay a price in terms of less than. 1. Short-term bond fund The best alternative for investors who do not want exposure to FDs or volatile instruments. i. Risk-Averse. These are the investors that have to dislike the risk, so they basically like to make investments in the assets that have a sure return. Risk aversion is the behaviour exhibited by investors when they prefer outcomes with assured returns over outcomes which have higher, but uncertain returns. Key Takeaways. Risk-averse investors often focus on capital preservation and income generation and avoid taking on select low-risk investment options. The money market is home to short-term debt investments. It gives the investor an opportunity to invest in highly liquid vehicles like call deposits. How do we measure the risk aversion of an investor? Several qualitative psychological methods suggest that one should determine what is the most appropriate. If you're a risk-averse investor, the opposite is true. You would opt for investments that aim to 'defend' your investments against losses – even if it. Proof that Diversification Reduces Risk. Consider a two risky asset example. An investor invests the fraction 1− f of his wealth in a low-risk asset. In economics and finance, risk aversion is the tendency of people to prefer outcomes with low uncertainty to those outcomes with high uncertainty. A risk-averse investor will gravitate towards a guaranteed outcome and shy away from risky investments. A lower, certain return will be preferable to a higher. Prospect theory and the idea of investors being loss-averse rather than risk-averse go back to Daniel Kahneman and Amos Tversky (). Describes an investor who, when faced with two investments with the same expected return but different risks, prefers the one with the lower risk. Conservative investing is an example of a risk-averse investment strategy. Conservative investing is an investment strategy that focuses on lower-risk. The ideal way to kick start your investment journey is to start small, learn from your mistakes and then move forward accordingly to minimize your losses. If. Smart investors consider both risk and return. Investments with higher expected returns (and higher volatility), like stocks, tend to be riskier than a more. Risk aversion relates to the notion that investors as a rule would rather avoid risk. Given a choice of two investments with equal returns, risk-averse. Risk-averse investors do not like taking risks. They prefer lower returns instead of higher ones because the lower return investments are less risky. A risk-loving investor might be more willing to take chances on new and unproven companies (startups), while a risk-averse investor would prefer.

Tiny House Stocks

Tiny home investing involves purchasing or developing a tiny home that you will then rent out. Tiny homes are most commonly rented through Airbnb and similar. They're mobile homes/trailers. "Tiny home" is just a 'boujee' and aspirational marketing term that glosses over the fact that they are portable trailers. Sprout Tiny Homes Inc. ; 52 Wk Range - ; Market Value, $M ; Revenue. M ; Net Income. M ; Net Profit Margin. %. We offer high-performance, all-electric, prefab homes for the climate era. They exceed Passive House Standards, are Net-Positive and significantly lower the. Sprout Tiny Homes, Inc. designs, develops, and manufactures tiny homes. It manufactures tiny homes on wheels and homes on foundations. Find Small House stock images in HD and millions of other royalty-free stock photos, illustrations and vectors in the Shutterstock collection. Fueled by our passion for elevated craftsmanship, we specialize in creating bespoke, top-tier tiny homes that prioritize comfort and affordability. Reasons Icon. TINY | Complete Tiny Ltd. stock news by MarketWatch. View real-time stock Home · Investing · Quotes · Stocks · Canada · TINY; Overview. Stock Screener. A high-level overview of Sprout Tiny Homes, Inc. (STHI) stock. Stay up to date on the latest stock price, chart, news, analysis, fundamentals, trading and. Tiny home investing involves purchasing or developing a tiny home that you will then rent out. Tiny homes are most commonly rented through Airbnb and similar. They're mobile homes/trailers. "Tiny home" is just a 'boujee' and aspirational marketing term that glosses over the fact that they are portable trailers. Sprout Tiny Homes Inc. ; 52 Wk Range - ; Market Value, $M ; Revenue. M ; Net Income. M ; Net Profit Margin. %. We offer high-performance, all-electric, prefab homes for the climate era. They exceed Passive House Standards, are Net-Positive and significantly lower the. Sprout Tiny Homes, Inc. designs, develops, and manufactures tiny homes. It manufactures tiny homes on wheels and homes on foundations. Find Small House stock images in HD and millions of other royalty-free stock photos, illustrations and vectors in the Shutterstock collection. Fueled by our passion for elevated craftsmanship, we specialize in creating bespoke, top-tier tiny homes that prioritize comfort and affordability. Reasons Icon. TINY | Complete Tiny Ltd. stock news by MarketWatch. View real-time stock Home · Investing · Quotes · Stocks · Canada · TINY; Overview. Stock Screener. A high-level overview of Sprout Tiny Homes, Inc. (STHI) stock. Stay up to date on the latest stock price, chart, news, analysis, fundamentals, trading and.

2. Expansion into new markets – Sprout Tiny Homes has the potential to expand beyond their current market by targeting urban areas with limited space, vacation. Tiny Home Big Hope! The Tiny Homes are really amazing. Each one is 64 sq. ft. in size, has two beds, heat, air-conditioning, windows, a small desk and a. Exciting News: Tiny Homes Now Available for DELIVERY! ✨ Our wide range of options available for immediate delivery include: The Vista. He accepts Stocks/Mutual Funds as collateral. These cannot be tied up in Balcony: "Tree House" Tiny Home on Wheels. Tour our biggest 3 Bedroom Tiny. Discover real-time Sprout Tiny Homes (STHI) stock prices, quotes, historical data, news, and Insights for informed trading and investment decisions. Complete Sprout Tiny Homes Inc. stock information by Barron's. View real-time STHI stock price and news, along with industry-best analysis. Tiny Homes are an innovative, affordable, and scalable solution to the humanitarian crisis known as homelessness. Unlike traditional shelter or affordable. Sprout Tech Homes Inc., formerly Sprout Tiny Homes, Inc., is focused on acquiring businesses, which are engaged in the business of designing, developing and. This Lego foldable tiny house, inspired by the Boxabl Casita model, is a marvel of miniature engineering. It features over bricks and opens like origami to. Holiday homes have proven to be a safe investment, offering an attractive return. At Basecamp, you can purchase a tiny house or villa in a resort where you feel. Any good tiny house companies that offer public stock for me to buy? Discussion. I really feel that the tiny house movement is going to get. Sprout Tiny Homes OTCPK:STHI Stock Report ; Last Price. US$ ; Market Cap. US$m ; 7D. % ; 1Y. % ; Updated. 21 Aug, What is the housing stock of tiny? The housing stock of Tiny is composed primarily of single detached homes and townhouses. · Why is the tiny house market rising. He accepts Stocks/Mutual Funds as collateral. These cannot be tied up in Balcony: "Tree House" Tiny Home on Wheels. Tour our biggest 3 Bedroom Tiny. We design, permit, manufacture, and install backyard homes in Los Angeles. Completely custom to your property, no subcontractors to deal with, and with a fixed. GreenPod announces collaboration with Colorado based Sprout Tiny Homes! Their modular home factory will build and debut our WaterHaus Design. TINY | Complete Tiny Ltd. stock news by MarketWatch. View real-time stock Home · Investing · Quotes · Stocks · Canada · TINY; Overview. Stock Screener. We design, permit, manufacture, and install backyard homes in Los Angeles. Completely custom to your property, no subcontractors to deal with, and with a fixed. Compare Big Tiny to Competitors Tiny Homes of Maine specializes in the construction of customizable tiny homes suitable for the severe winters of New England. Find Small House stock images in HD and millions of other royalty-free stock photos, illustrations and vectors in the Shutterstock collection.

Selling Stock For Cash

Selling a stock that has lost value. If you don't feel positive about the stock's prospects, you might be ready to sell. If you are selling at a loss, you. If John sells AAPL stock prior to Wednesday (the settlement date of the GME sale), the transaction would be deemed a good faith violation because AAPL stock was. If you would like to sell stock using Cash App Investing: Tap the Money tab on your Cash App home screen; Tap on the Stocks Tile; Scroll down to Stocks. Cash App Investing has a minimum sale amount of $1 · You can sell all or part of your stock. · If a sell order is placed that's close to the total amount owned. The Sell Shares menu item will only be available if you have opened your. Merrill Lynch brokerage account (LIIA). Choose Total Quantity to Sell or Select Tax. One of the approaches in the Fidelity stock cash-out process involves selling stocks at their current market value, allowing investors to liquidate their. Key Takeaways · Selling a stock is just as important and intensive of an operation as buying a stock. · Investors should create a strategy for buying, holding, or. Here's an example: You borrow 10 shares of a company (or an ETF), then immediately sell them on the stock market for $10 each, generating $ If the price. In Sell In, select either Dollars or Shares, or change the order type, and then enter the amount to sell. Select. Selling a stock that has lost value. If you don't feel positive about the stock's prospects, you might be ready to sell. If you are selling at a loss, you. If John sells AAPL stock prior to Wednesday (the settlement date of the GME sale), the transaction would be deemed a good faith violation because AAPL stock was. If you would like to sell stock using Cash App Investing: Tap the Money tab on your Cash App home screen; Tap on the Stocks Tile; Scroll down to Stocks. Cash App Investing has a minimum sale amount of $1 · You can sell all or part of your stock. · If a sell order is placed that's close to the total amount owned. The Sell Shares menu item will only be available if you have opened your. Merrill Lynch brokerage account (LIIA). Choose Total Quantity to Sell or Select Tax. One of the approaches in the Fidelity stock cash-out process involves selling stocks at their current market value, allowing investors to liquidate their. Key Takeaways · Selling a stock is just as important and intensive of an operation as buying a stock. · Investors should create a strategy for buying, holding, or. Here's an example: You borrow 10 shares of a company (or an ETF), then immediately sell them on the stock market for $10 each, generating $ If the price. In Sell In, select either Dollars or Shares, or change the order type, and then enter the amount to sell. Select.

When Should You Sell a Stock: 5 Main Reasons to Cash Out. Knowing when to Instead of freaking out and selling your stock faster than you can scream, “SELL! Investors who sell cash-secured puts generally are willing to buy the underlying shares of stock. Rather than buy the shares at the current price, however, they. You can cash them in through the transfer agent of the company with which the stock is owned. Or, you can work with a broker to sell the stock. If you sell your stock before the ex-dividend date, you also are selling away your right to the stock dividend. Your sale includes an obligation to deliver. If you're looking to lock in some of those gains (aka tax-gain harvesting), selling some of your losers can help minimize your capital gains taxes. Using a tax. By donating stock that has appreciated for more than a year, you are actually giving 20 percent more than if you sold the stock and then made a cash donation. When one sells a stock, the money for the trade is expected to be in the brokerage firm on the third day after the trade date. This is usually two business. If you bought it using settled cash, you can sell it at any time. But if you buy a stock with unsettled funds, selling it before the funds used to purchase. To short your stock, you borrow shares from your broker and then sell them in the open market. You pay back the loan with stock in the form of exercised options. The $25, margin requirement can be met by combining cash and securities—but must be in a trader's account prior to their conducting day trades. Day traders. Understand capital gains and losses. Clearly identify the lot of shares you want to sell. · Job loss? Carefully follow your company's post-termination stock. Just pick a stock, choose how much to give, and send it like you would cash. Download Cash App. When traders buy stock, they also need to think about their exit strategy. Kevin Horner describes the different sell orders you can use to exit a position. Capital gains. Stocks are bought and sold constantly throughout each trading day, and their prices change all the time. When the price of a stock increases. Capital gains. Stocks are bought and sold constantly throughout each trading day, and their prices change all the time. When the price of a stock increases. Please note that there's a mandatory two business day holding period after the sale before your cash will be available to use. sell securities. Any historical. To sell stocks on Robinhood, you will need a minimum of $ in your account before selling individual shares or your entire portfolio. Once. A cash liquidation violation occurs when you buy securities and cover the cost of that purchase by selling other fully paid securities after the purchase date. In stock transactions, that risk is shared with selling shareholders. More precisely, in stock transactions, the synergy risk is shared in proportion to the. Then log in to Publix Stockholder Online > Account Tools > Sell Stock and follow the on-screen process to complete and print the required form. Be sure to.

1 2 3 4 5